Understanding Forex Trading Options A Guide for New Traders

Understanding Forex Trading Options: A Guide for New Traders

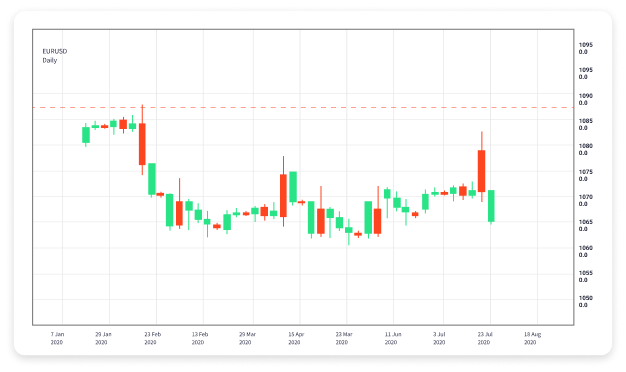

Forex trading options have gained immense popularity among investors looking to capitalize on the fluctuations in currency values. For those not familiar with the concept, forex trading involves the buying and selling of currency pairs in a decentralized market, often referred to as the foreign exchange market. One way to enhance trading strategies within this market is through options trading. For comprehensive insights into this dynamic field, consider exploring forex trading options Trading Brokers in Qatar, which can provide valuable resources for traders.

What Are Forex Trading Options?

Forex trading options are financial derivatives that give traders the right, but not the obligation, to buy or sell a currency pair at a predetermined price (referred to as the strike price) before a specified expiration date. Unlike traditional currency trading, where traders must commit to the trade immediately, an option allows traders to speculate on currency movements without requiring them to hold the currency itself.

Types of Forex Options

There are two primary types of forex options: call options and put options. A call option gives the holder the right to buy a currency pair, while a put option gives them the right to sell the currency pair. These options can be an invaluable tool for managing risk, hedging existing positions, or speculating on future price movements.

Call Options

Traders purchase call options when they anticipate that the price of the currency pair will rise. By leveraging a call option, traders can gain exposure to potential gains while limiting their financial risk to the cost of the option premium. This characteristic makes call options particularly attractive in bullish market conditions.

Put Options

Conversely, put options are bought when traders expect the price of the currency pair to decline. A put option allows traders to profit from falling prices, thus providing a hedge against adverse market movements. The risk is again limited to the premium paid for the option, making it an essential tool in risk management for forex traders.

Why Trade Forex Options?

There are several compelling reasons why traders might choose to engage in forex options trading:

- Leverage: Forex options allow traders to control a larger position with a smaller amount of capital compared to direct currency trading.

- Risk management: Options can act as a hedge against adverse market movements, enabling traders to protect their investments.

- Flexibility: Options provide various strategies to profit from different market conditions, whether bullish, bearish, or sideways trends.

- Defined risk: The risk in options trading is limited to the premium paid, allowing traders to manage their exposure better.

Strategies for Trading Forex Options

Successful trading in forex options requires a good grasp of various strategies. Here are a few popular ones:

1. Buying Call and Put Options

This basic strategy involves purchasing call or put options based on your market expectations. If you believe a currency pair will rise, you might buy a call option. If you think it will fall, you might buy a put option.

2. Straddles

A straddle involves simultaneously buying a call option and a put option with the same strike price and expiration. This strategy is useful when you anticipate significant price movement but are unsure of the direction. If the currency pair moves significantly in either direction, gains from one of the options can offset the loss from the other.

3. Spreads

Options spreads involve buying one option and simultaneously selling another option with a different strike price or expiration date. Spreads can reduce risk and cost but also limit potential profits.

Getting Started with Forex Options Trading

If you are new to trading forex options, here are some steps to get you started:

- Choose the Right Broker: Select a reputable broker offering forex options trading. Consider factors like fees, trading platform, and customer service.

- Understand the Market: Take the time to learn about the forex market, focusing on currency pairs and economic factors influencing exchange rates.

- Practice Trading: Utilize demo accounts to practice trading strategies without risking real money. Familiarize yourself with how options work.

- Develop a Trading Plan: Create a trading plan that outlines your strategies, risk tolerance, and profit targets. Stick to your plan to avoid emotional trading.

Conclusion

Forex trading options offer a unique opportunity for traders to manage risk and capitalize on price movements in the currency market. By understanding the different types of options, their advantages, and various trading strategies, traders can enhance their trading experience. As with any form of trading, thorough research, practice, and a solid trading plan are crucial to achieving long-term success in forex options trading.