Understanding the Forex Market A Comprehensive Guide to Trading 1807277766

The Forex market, short for foreign exchange, is one of the most dynamic and liquid financial markets in the world. With a daily trading volume exceeding $6 trillion, Forex offers numerous opportunities for traders and investors. Understanding this market requires knowledge of various factors, including trading strategies, market analysis, and the importance of selecting the right brokers. In this article, we will explore the intricacies of Forex trading and why forex market trading MT4 Forex Brokers are essential for successful trading.

What is Forex Trading?

Forex trading involves the buying and selling of currencies on the foreign exchange market. Unlike stock markets that focus on trading company shares, Forex is about currency pairs. For example, trading the EUR/USD pair means you are trading the Euro against the US Dollar. The goal is to speculate on the currency price fluctuations and make a profit.

How Forex Trading Works

The Forex market operates on several key principles. First, it is a decentralized market, meaning transactions are conducted over-the-counter (OTC) rather than on a centralized exchange. This leads to more flexible trading hours, with the market open 24 hours a day from Sunday evening until Friday evening.

Understanding Currency Pairs

In Forex trading, currencies are quoted in pairs, such as GBP/USD or USD/JPY. The first currency in the pair is known as the base currency, while the second one is the quote currency. The exchange rate represents how much of the quote currency is needed to purchase one unit of the base currency. For example, if the GBP/USD exchange rate is 1.3000, it means 1 British Pound is worth 1.30 US Dollars.

Market Participants

The Forex market comprises various participants, including central banks, financial institutions, corporations, retail traders, and hedge funds. Each participant has distinct motivations and trading strategies, influencing market dynamics and price movements.

Types of Analysis in Forex Trading

Successful Forex trading relies heavily on market analysis. Traders typically use three main types of analysis: fundamental analysis, technical analysis, and sentiment analysis.

Fundamental Analysis

Fundamental analysis involves evaluating economic indicators, interest rates, and geopolitical events that can affect currency values. Key indicators include GDP growth, employment rates, and inflation. Traders who employ this approach attempt to predict currency movements based on economic data and news releases.

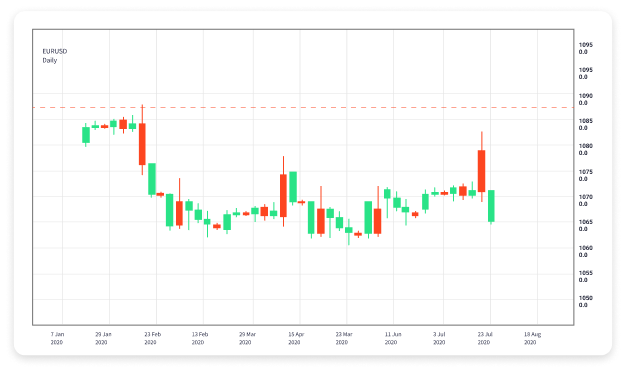

Technical Analysis

On the other hand, technical analysis focuses on historical price data and market trends. Traders use various tools and techniques, such as charts, indicators, and patterns to identify entry and exit points. Popular tools include moving averages, RSI (Relative Strength Index), and Fibonacci retracements.

Sentiment Analysis

Sentiment analysis is often used to gauge market sentiment or the collective attitude of traders toward a particular currency. This approach considers factors such as trader positioning—whether the majority of traders are long or short on a currency pair—and can serve as a valuable tool for traders looking to understand potential market reversals.

Developing a Trading Strategy

Having a well-defined trading strategy is crucial for success in Forex trading. Your trading plan should specify your risk tolerance, trading style, and objectives. Here are some common trading styles:

Day Trading

Day traders open and close trades within the same day, seeking to profit from smaller price movements. This style requires a strong grasp of technical analysis and the ability to make quick decisions.

Swing Trading

Swing traders hold positions for several days or weeks, aiming to capitalize on larger price swings. This approach combines both technical and fundamental analysis, allowing traders to identify medium-term trends.

Position Trading

Position traders have a long-term outlook, holding trades for weeks, months, or even years. This style relies significantly on fundamental analysis and macroeconomic trends.

Choosing the Right Forex Broker

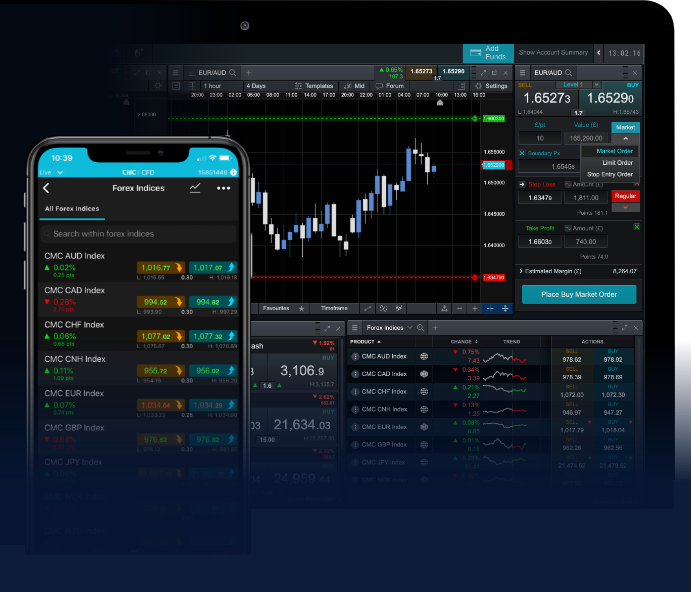

Selecting a reputable Forex broker is vital for successful trading. Factors to consider when choosing a broker include regulation, trading platform, spreads and commissions, and customer support. Many traders prefer brokers that offer MT4 Forex Brokers due to the platform’s robust features, ease of use, and comprehensive analytical tools.

Managing Risk in Forex Trading

Effective risk management is crucial for a trader’s longevity in the Forex market. Here are some strategies to manage risk:

Use Stop-Loss Orders

Implementing stop-loss orders helps traders limit potential losses by automatically closing a position when a specific price is reached. This can safeguard your trading capital and maintain discipline.

Position Sizing

Determining the appropriate position size based on your account balance and risk tolerance is vital. Many traders use a rule of thumb to risk no more than 1-2% of their trading capital on a single trade.

Conclusion

Forex trading is a complex yet exciting endeavor that can lead to significant rewards when approached with the right knowledge and strategy. Understanding the dynamics of currency trading, mastering different analysis techniques, and implementing effective risk management practices are key components of achieving success in this market. By continually educating yourself and adapting to market changes, you can navigate the Forex market effectively and improve your trading outcomes.