Petty Money

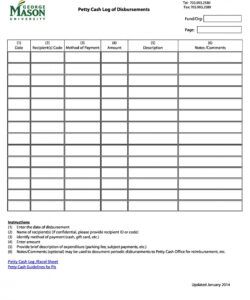

The second journal entry is debiting petty cash and credit cash readily available (any cash account). A designated worker, the petty money custodian, accounts on your business’s use of petty cash. When an employee takes cash from the petty money fund, the petty cash custodian must report who took the money, the amount taken, what the money is for, and the date. You should report petty cash transactions, even when you think they’re too low to matter. With Out a petty money system, using small money quantities periodically can add up to a serious discrepancy in your books.

- Having a petty cash fund accelerates reimbursements and is a crucial finest follow in cash administration.

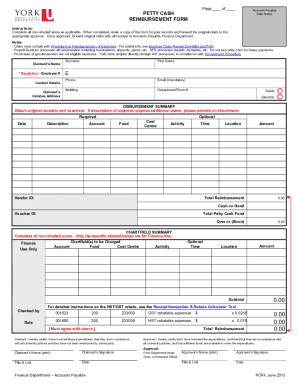

- This is completed by issuing a examine (or utilizing electronic transfer) to the petty money custodian for the exact amount of documented expenses.

- The overseer’s duties embrace implementing all petty money rules and laws, requesting, replenishing and allotting of funds.

- Lastly, you need to select a maximum quantity that staff can request for petty money transactions.

Step 3: Identifying Bills

To accomplish the reimbursement, the treasurer’s office supplies the requested quantity (by examine or currency) to the custodian. Petty money lets firms keep away from advanced processes associated to the banking system. Evaluation petty cash do’s and don’ts to guarantee you appropriately deal with your fund. Petty cash might represent a small portion of your general petty cash reimbursement journal entry finances, however it performs a meaningful position in maintaining daily operations working smoothly. This operation makes sure the transaction is properly mirrored in your common ledger. This entry displays how the whole spent is distributed across related expense categories.

Errors In Cash E-book

At any cut-off date, the receipts plus the remaining cash ought to equal the balance of the petty cash fund (i.e., the amount of cash originally positioned in the fund). Understanding and correctly recording a petty cash journal entry is crucial for accurate financial record-keeping in any enterprise. With Out https://www.kelleysbookkeeping.com/ this, even probably the most diligent custodian might wrestle with accurate record-keeping. Observe that the entry to report replenishing the fund does not credit the Petty Money account.

Incessantly Asked Questions On Recording Petty Cash Reimbursement

Nevertheless, it ought to be replenished at the end of the accounting period so as to make positive that all bills are correctly recorded. Lastly, ABC Co. used its bank account to deposit $1,500 into the petty money account. The company used this transaction to restore that account to its designated limit. ABC Co. used the following journal entries to report the transfer. Therefore, the journal entry would require corporations to transfer the transferred amount between these accounts. Here, the bank account would be the credit score aspect, while the petty money account is the debit.

This may be the outcomes of simple errors, similar to math errors in making change, or maybe someone failed to supply a receipt for an applicable expenditure. No Matter the cause, the available money must be brought back to the appropriate level. In a easy system, all petty cash expenditures are documented as they happen. The whole of those prices is added to the petty cash account monthly, and the monthly quantity is entered into the Common Ledger as an expense. Petty money refers to a system of holding insignificant sums of funds to pay for minor bills.

Dejar un comentario

¿Quieres unirte a la conversación?Siéntete libre de contribuir!